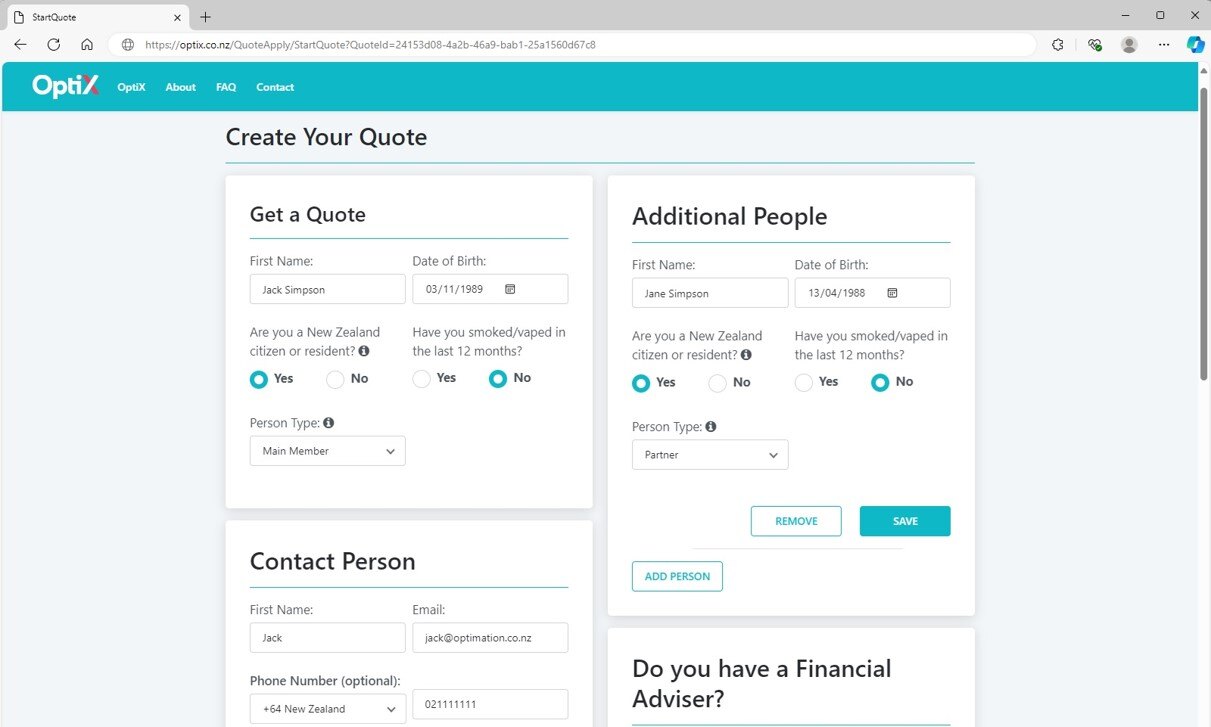

Quote & Apply

An advanced customer facing system that allows customers and prospects to get a quote and apply for insurance—automatically.

- Customisable multi-person and multi-product applications, tailored coverage and eligibility

- Instant quote generation.

- Multiple secure payment options.

- Seamless link from quote to application process

- Referral to manual underwriting (if required).

- Easy integration into your existing website for consistency.

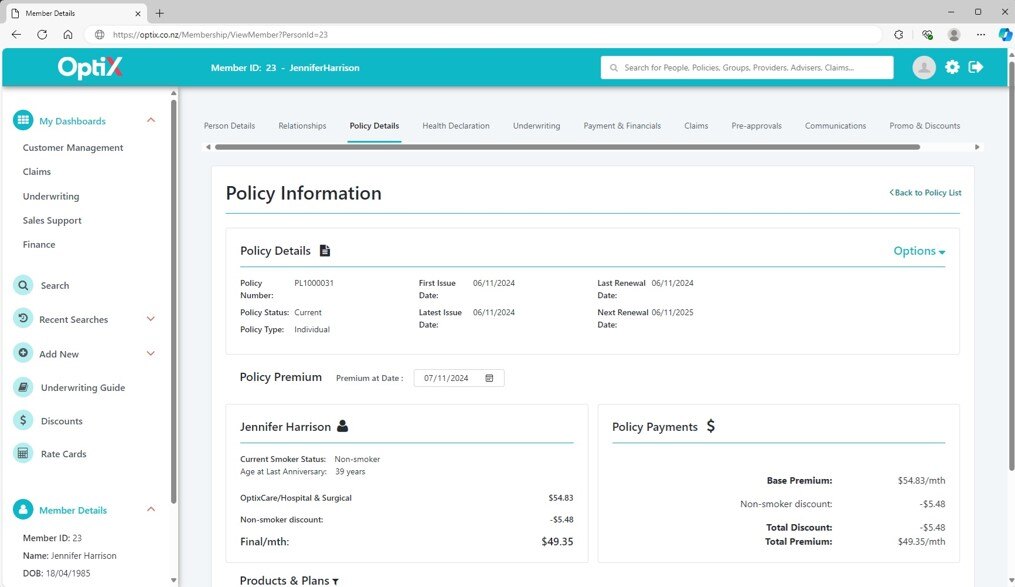

Policy Management

Enhanced control over policy administration to ensure all policy details are accurate and up to date, and that changes can be managed accurately and in real-time.

- Designed to be people rather than policy centric to provide a complete view of customers and their journeys.

- Manage changes to policy details, including changes to personal details, addition or removal of members, product details, suspensions and cancellations.

- Securely capture and track payment details and history.

- Easily track all policy-related activity in real time, ensuring up-to-date records.

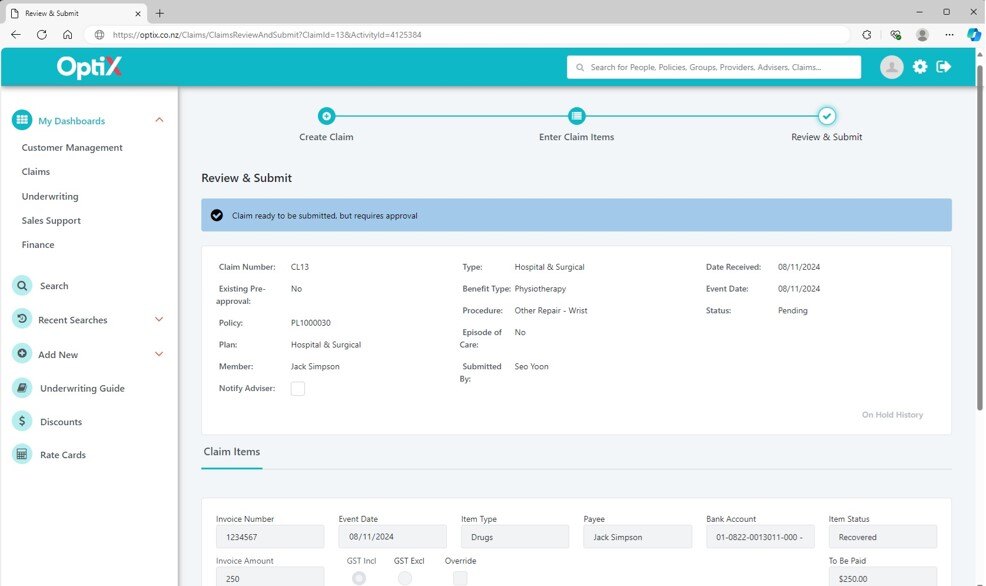

Claim Assessment & Pre-approval

Empower operational teams with intuitive workflows for claims, pre-approval, processing, and payments. Seamlessly handle claims, make payments and providers, and access detailed claim history.

- Streamlined and integrated workflow for claim review and approval.

- Product-specific annual and lifetime benefit limits applied automatically to prevent over payments at claim time.

- Flexible payment options for providers or members.

- Built-in workflows for primary, hospital, and surgical claims.

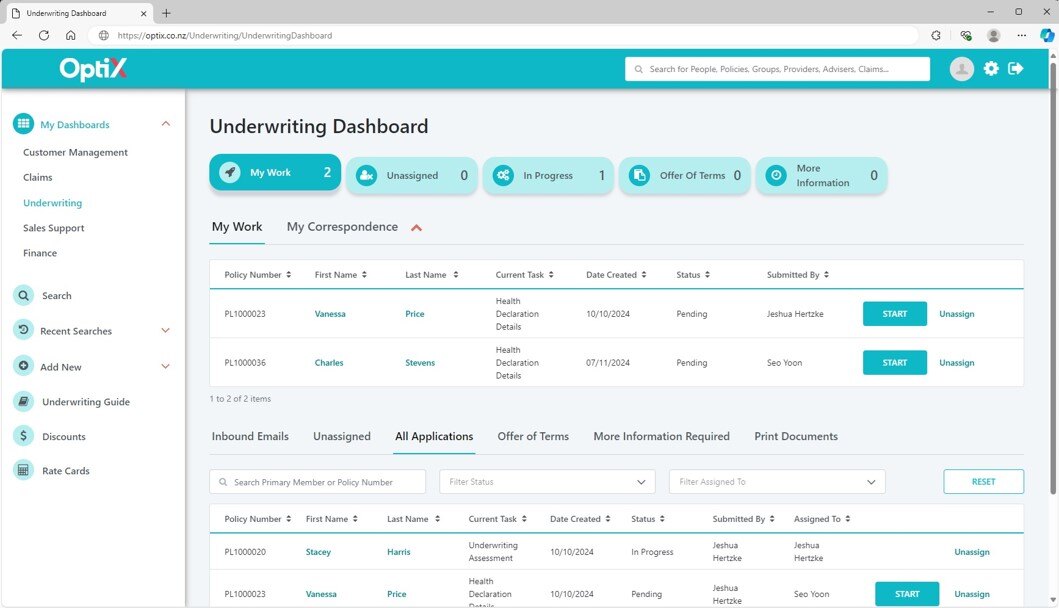

Underwriting Workbench

Streamline your underwriting processes with the integrated underwriting workbench offering efficient decisions and operations.

- Manual workflow to assess each individual's health conditions and apply exclusions

- Ability to add exclusions per health condition and link to specific or all plans where health condition is excluded from policy.

- Ability to integrate your Underwriting Rules to help underwriters assess health conditions and apply correct exclusions

- Underwriting review workflow to review/reassess existing exclusions.

- Extensibility to incorporate an automated underwriting engine option.

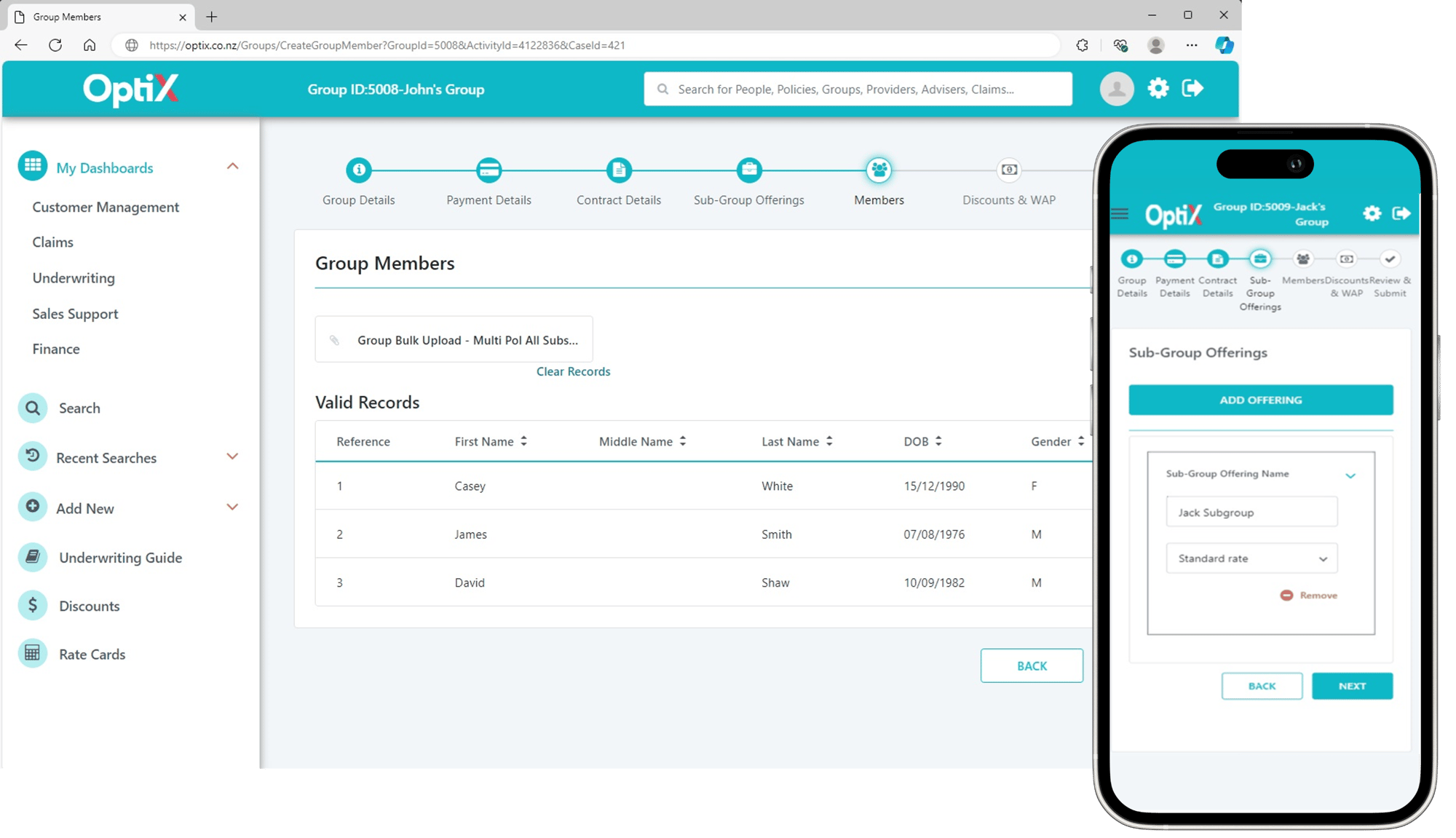

Group Insurance

Effortlessly manage the complexity of employer and group insurance contracts which involve multiple members.

- Bulk upload of employees on a group policy

- Ability to easily update new entries and exits from groups

- Accommodate fully subsidised and partially subsidised group schemes

- Ability to maintain individual policies for those leaving groups with continuity of cover

Correspondence & Notifications

Supercharge your communications with automated correspondence and notifications. Stay connected, save time, and never miss a beat!

- Automatically send notifications upon workflow completion, incl. policy, claims, invoices and reminders, with manual email options.

- Create or modify notification templates, adjusting content & timing as needed.

- Track notification status in real-time.

- Automatically file outbound notifications in the CRM for easy access.

- Customize settings for alerts and reminders based on user preferences.

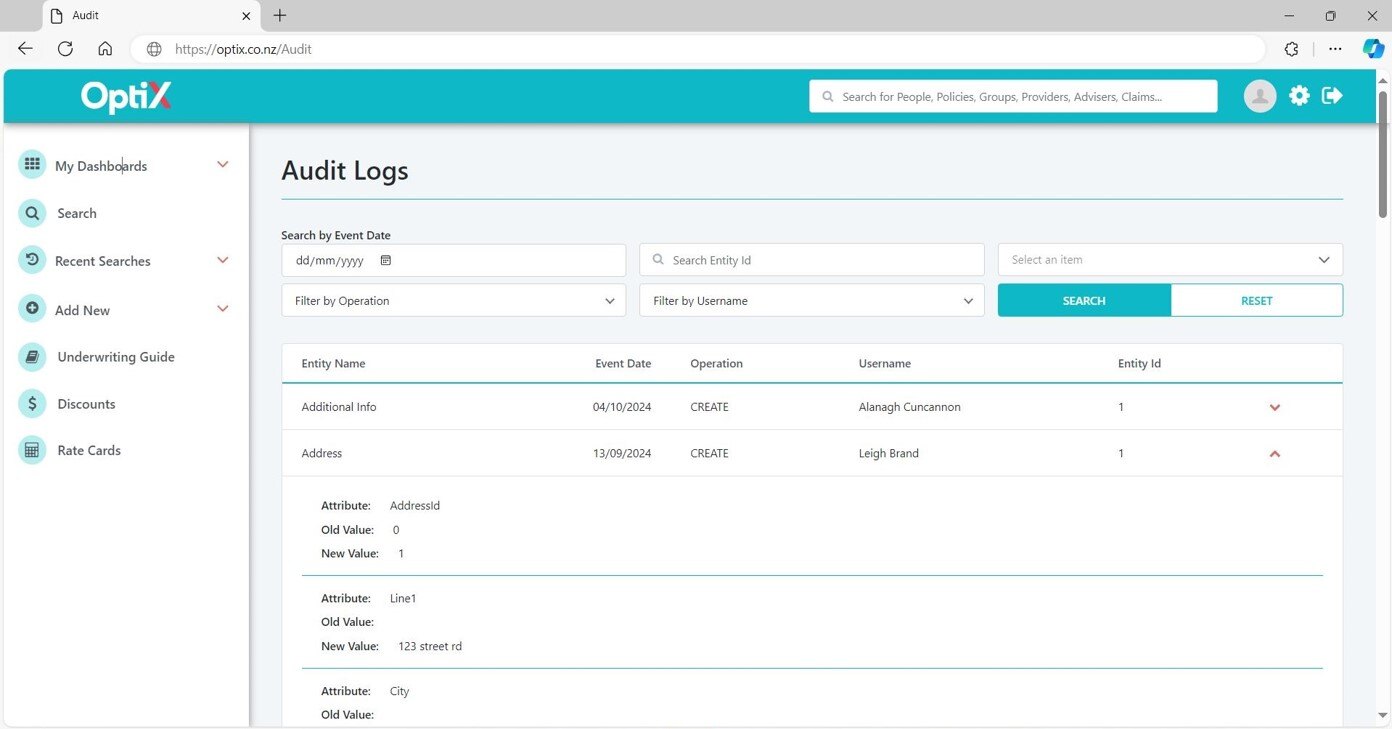

Reporting & Audits

With robust reporting functions, unlock the power of data and gain valuable, actionable insights to make informed decisions.

- Track key metrics in real time.

- Access insights via data analysis tools for informed decision-making.

- Produce system generated or customised reports to ensure transparency and accountability.

- Enable auditing features to identify and trace user and system actions, ensuring compliance and peace of mind.

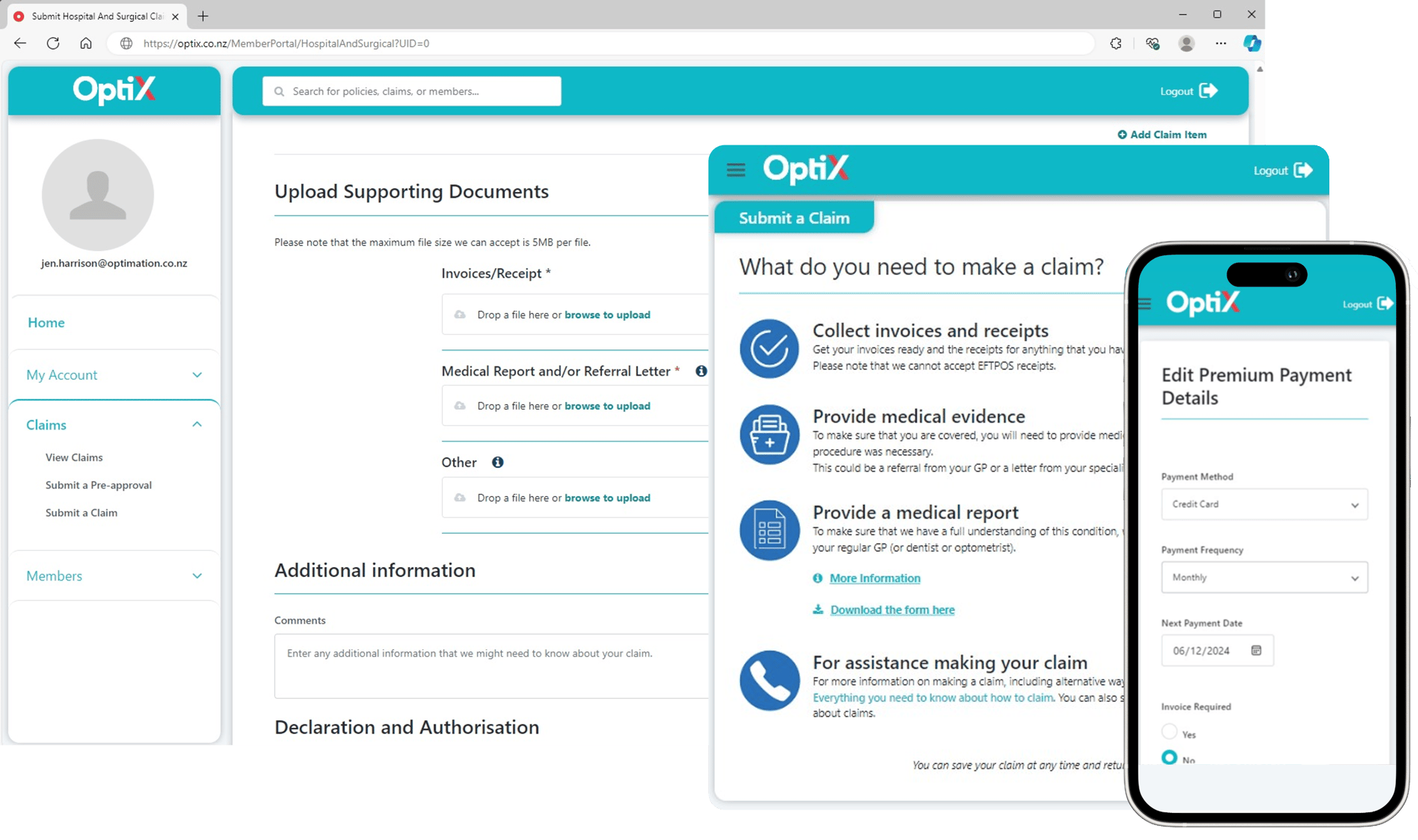

Self Service Customer Portal

Elevate customer satisfaction and reduce cost-to-serve through a comprehensive self-service portal where customers can directly manage their policies and plans, claims, payments, documents, and more.

- Customers can easily view all claim and pre-approval history, providing full transparency on their submissions.

- Quickly update personal and payment details for seamless account management and accuracy.

- View detailed policy information, including member coverage and premiums

- Submit claims or pre-approvals and track status in real-time, reducing the need for follow-up inquiries.

- Comprehensive financial module to detail charges and payments.

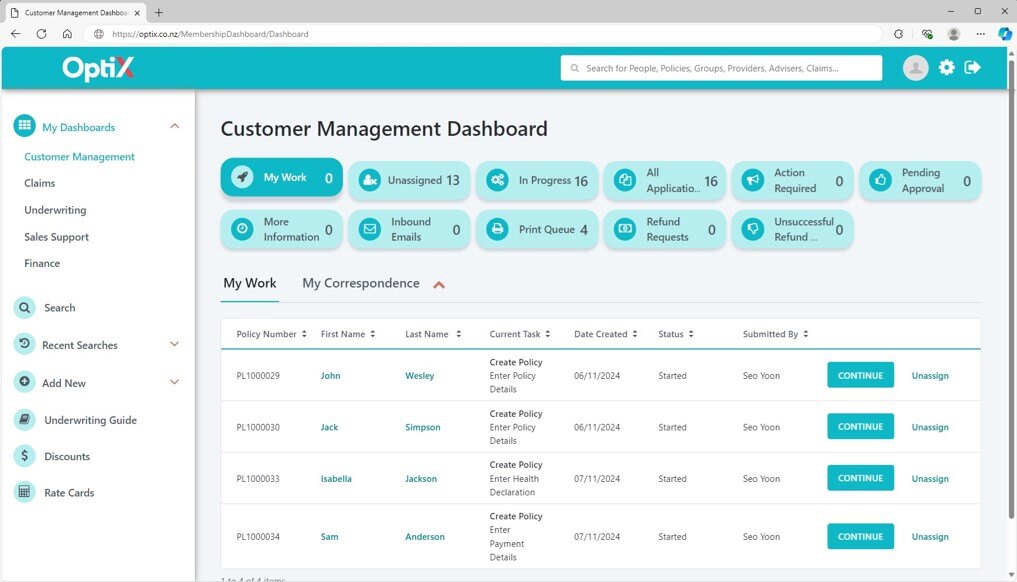

Customer Management Dashboard

Efficiently manage tasks and workflows in this central hub for seamless team collaboration. With easy task assignment, tracking, and completion, your team can stay focused on delivering exceptional results.

- Comprehensive dashboard for workflow management to track, assign, and manage tasks.

- Built-in CRM to manage inbound emails.

- Automated workflow sorting to direct tasks to the right queues.

- Flexible task assignment and reassignment to balance workloads and ensure coverage.

- Advanced search and filter functions.

- Realtime updates

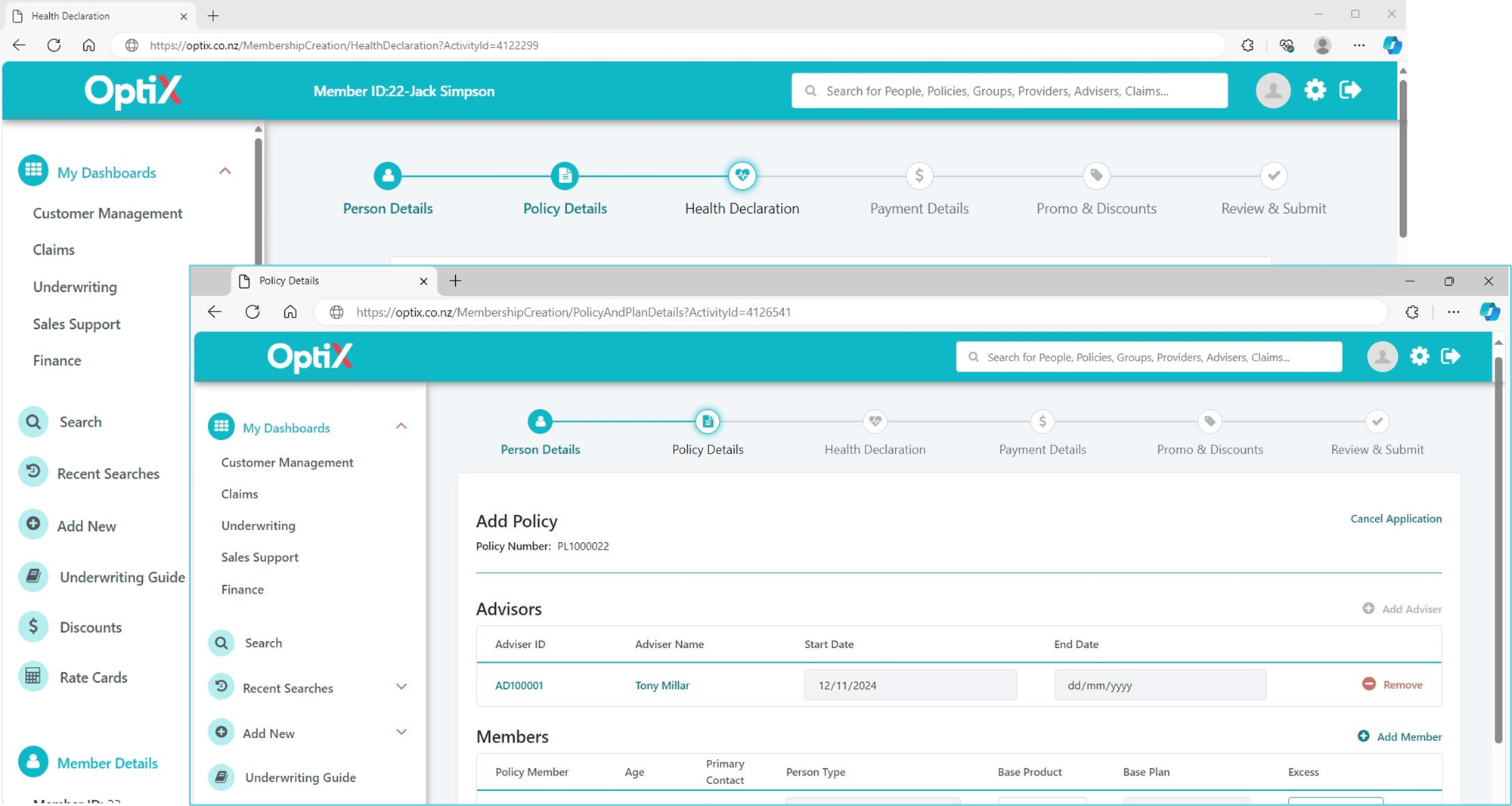

Integrated Workflow

Seamless and adaptable integrated workflows for all key policy administration functions across both new and existing customers, and moments of truth in the customer lifecycle.

- Intuitive designs to make complicated workflows seamless and easy to flow.

- Workflows are integrated with the data base to provide real time information about the member or policy.

- All workflows integrate with SendGrid to send out automated correspondence for Members, Advisers or Providers.

- Workflows integrate across systems ensuring all business areas complete tasks in order, making it a seamless end-to-end solution for issuing policies or completing claims.

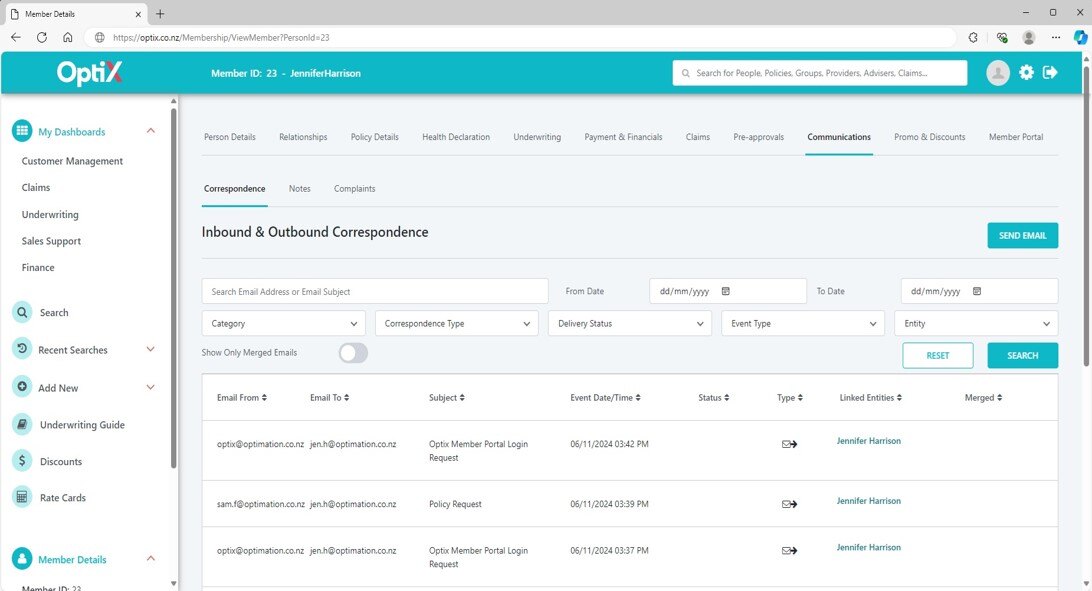

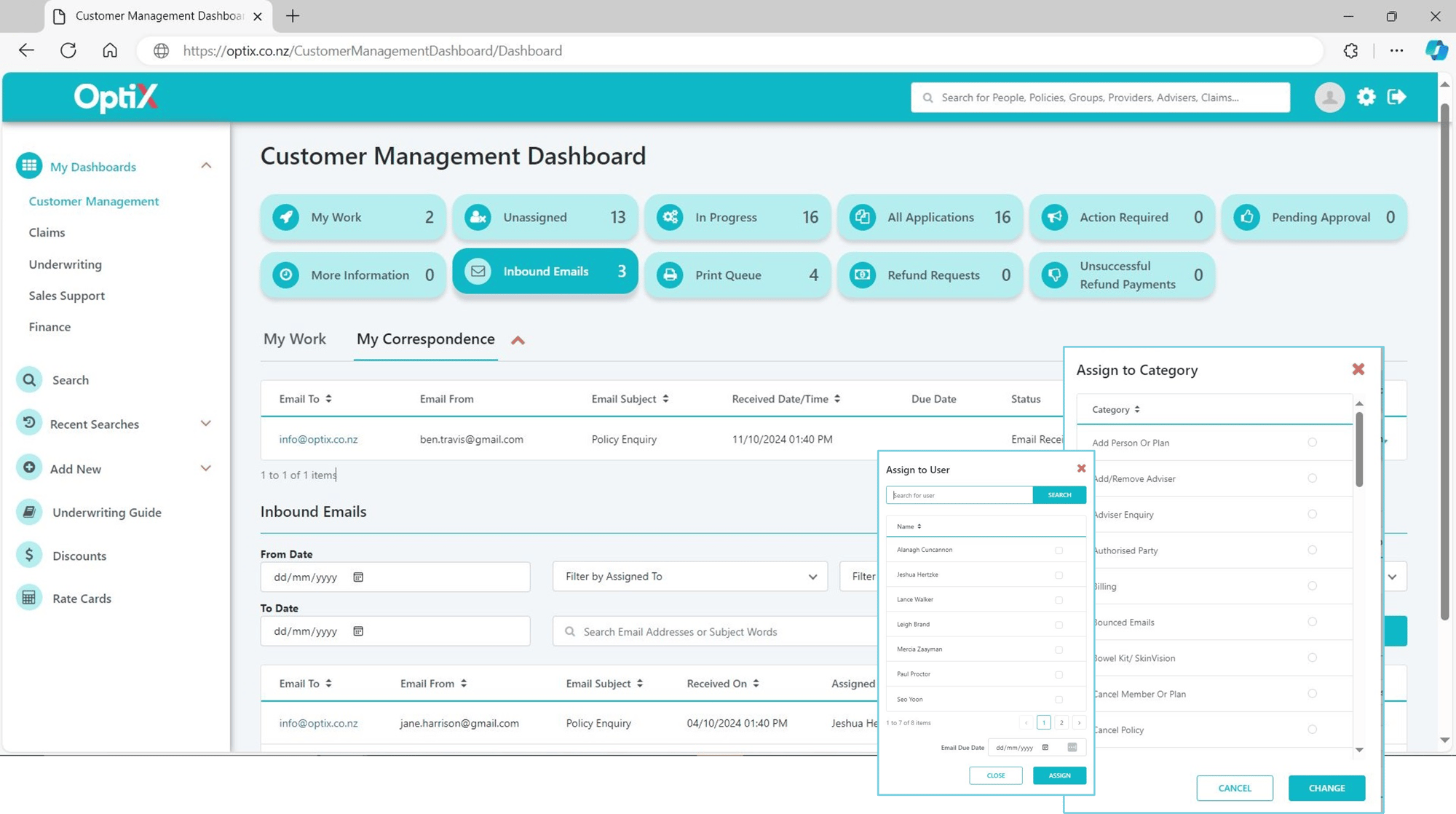

Embedded CRM

Track every customer interaction, ensuring a comprehensive record of all member correspondence, enhancing communication, and boosting customer satisfaction.

- Effortlessly access and categorise all system-generated correspondence.

- Full history of email correspondence with customers

- Assign or reassign tasks to users or teams.

- Link correspondence to policies for comprehensive tracking.

Certified Security

Feel confident about security with this solution based on Secure by Design principles.

- Robust multi-factor authentication required for the core system and Customer Portal access

- Role based authentication for user permissions which are linked to Active Directory for Single Sign-on ease.

- Regularly penetration tested by Security experts

- Platform is SOC2 compliant.

- Safely upload documents with built-in antivirus scanning.

Want to know more?

Make the switch to a smart insurance platform and work more efficiently.

Elevate your insurance operations and transform the way your company does business.

Paul Proctor | Head of Sales |